Large corporates with strong liquidity hold up ~Rs 3.3 lakh crore of payables to MSMEs

Mumbai: Liquidity challenges faced by medium, small and micro enterprises (MSMEs) in the past two years aggravated further in the first quarter of fiscal 2020 due to the Covid-19 impact on the Indian economy. The liquidity crunch being faced by MSMEs is on account of two key issues, including the lack of a funding line from the banking system and stretched working capital because of low bargaining power with large corporates to have payments released for materials supplied or services provided. BWR study reveals that close to Rs.3.3 lakh crore of MSME funds are stuck with strong large corporates in the form of receivables.

Access to funding from the organised banking sector has eased owing to the announcement of Rs 3 lakh crore collateral-free loans in the Aatmanirbhar Bharat Abhiyaan package, of which ~Rs 32,000 crore has already been sanctioned, with ~Rs 16,000 crore disbursed by banks as on 12 June 2020. However, the liquidity of MSMEs continues to be stretched, given the long credit period extracted from MSMEs by large corporates, many of which have sufficient liquidity of their own.

Says Mr. Rajat Bahl, Chief Ratings Officer, Brickwork Ratings, “Even if 50% of the funds held up by strong large corporates with high creditor days are released, it will shore up the liquidity for the MSME sector by close to Rs.1.6 lakh crore and significantly reduce their liquidity pressure and working capital burden.”

BWR study based on the data analysis of the top 1,000 companies in terms of market capitalisation is focused on companies that have negative or low working capital requirement, albeit high creditor days. While some of these corporates have weak liquidity and credit profiles, thus driving them toward extracting the maximum credit from their suppliers, others have strong credit profiles and liquidity.

Analysis

As part of our analysis, we studied data pertaining to the top 1,000 Indian companies as per market capitalisation. Of this sample set, after setting aside banking and financial sector entities, a total of 760 non-BFSI entities were considered.

The study was focused at companies that have a negative or low working capital requirement (low debtor days, but high creditor days).

| Total | % of companies | |

| Total companies | 760 | 100% |

| (-) ve WC companies | 92 | 12% |

| (+) ve but low WC but high creditor days | 15 | 2% |

Of 760 large corporates in all, 14% had a negative or low working capital requirement as on 30 September 2019, implying that while they gave lower credit to their buyers, they got high credit from their suppliers.

While some companies out of the above sample are strong entities managing their balance sheet to extract the maximum working capital benefit from their suppliers, others in the sample are facing a liquidity stretch, forcing them to stretch their creditors.

To further separate the above said two categories of corporates, BWR considered factors such as EBIDTA margins, Net Cash Accruals / Total Debt and Credit Ratings. Based on the above factors, two sets of corporates were identified:

- Strong entities – Strong corporates, market leaders in their domain with a strong bargaining power with MSME vendors/suppliers, with sufficient liquidity and low debt, but a negative or short working capital cycle due to high credit period enjoyed

- Entities with stretched credit profiles – Large companies with negative working capital due to high creditors and low debtors, but high debt obligations vis-à-vis their net cash accruals and dependence on stretching creditors to maintain liquidity

Out of the 107 companies with negative or low working capital requirement, but high creditor days, the further categorisation of the corporates showed the following results:

| Company Type | Numbers | % of total number of companies |

| Strong Corporates | 68 | 8.9% |

| Corporates with stretched credit profile | 39 | 5.1% |

| Total | 107 | 14.1% |

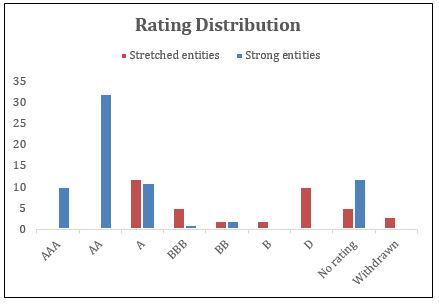

The rating distribution of the above classification also shows that strong corporates typically carry ratings of category A and above. However, corporates with a stretched credit profile were just investment grade or lower. This further corroborated our assessment of the liquidity situation of entities that have negative or low working capital.

Rating distribution between strong corporates and those with stretched credit profiles:

Sectoral distribution between strong corporates and those with stretched credit profiles:

| Strong Entities | Entities with Stretched Credit Profile |

| Automobiles | Infrastructure |

| FMCG | Power |

| Logistics | Real Estate |

Strong corporates avail nearly 33% of the total creditor period used by large corporates from MSMEs

| Number of companies | Creditors (Rs Lakh crore) as on Sept 2019 | % Creditor | |

| Large corporates | 760 | 9.76 | 100% |

| Entities with stretched credit profile | 39 | 0.64 | 7% |

| Strong Entities | 68 | 3.25 | 33% |

Source: Ace Equity, BWR Research

While it may be difficult for the 39 entities with stretched credit profiles to reduce creditor days, 68 strong corporates together held close to Rs.3.3 lakh crore of credit from suppliers on their balance sheet as of September 2019. Given the adverse economic conditions, large corporates have only increased their bargaining power with MSMEs in Q1FY21. BWR study shows that even if 50% of these funds held up by large corporates are released, it will shore up the liquidity for the MSME sector by close to Rs.1.6 lakh crore and reduce their liquidity pressure and working capital burden significantly. The reduction in the credit period enjoyed by large corporates with strong credit profiles can have a significant impact on easing the liquidity pressures of MSMEs.